CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

Centre accepts Cairn’s offer on retrospective tax

- IAS NEXT, Lucknow

- 20, Nov 2021

Moving quickly towards ending a retrospective tax dispute with a firm that gave India its largest oilfield, the government has accepted Cairn Energy PLC undertakings which would allow for the refund of taxes.

- The company will now be issued a ₹7,900 crore refund.

What’s the issue?

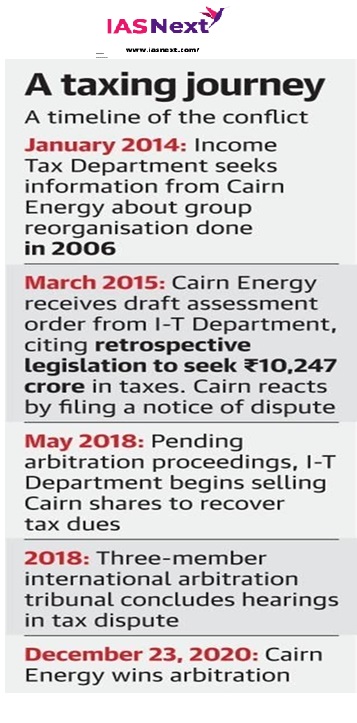

In December 2020, a three-member international arbitral tribunal at the Permanent Court of Arbitration in the Netherlands ruled unanimously that the Indian government was “in breach of the guarantee of fair and equitable treatment”, and against the India-UK Bilateral Investment Treaty, and that the breach caused a loss to the British energy company and ordered compensation of $1.2 billion.

- Cairn had challenged the Indian government seeking taxes over an internal business reorganisation using the 2012 retrospective tax law, under the UK-India Bilateral Investment Treaty.

- In 2014, the Indian tax department had demanded Rs 10,247 crore in taxes.

- In 2015, Cairn Energy Plc commenced international arbitration proceedings against the Indian government.

What next?

Please note that the Indian government's recent amendent to taxation laws nullifies the tax assessment originally levied against Cairn in January 2016 and orders the refund of ₹7,900 crore which was collected from Cairn in respect of that assessment.

What is retrospective taxation?

- It allows a country to pass a rule on taxing certain products, items or services and deals and charge companies from a time behind the date on which the law is passed.

- Countries use this route to correct any anomalies in their taxation policies that have, in the past, allowed companies to take advantage of such loopholes.

- Retrospective Taxation hurts companies that had knowingly or unknowingly interpreted the tax rules differently.