CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

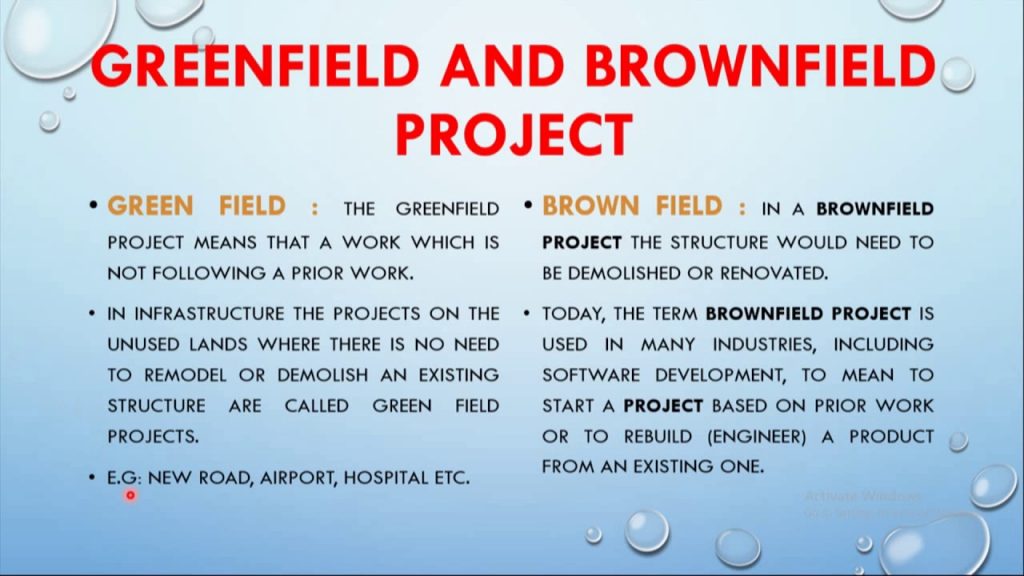

Greenfield and Brownfield projects

- Vaid's ICS, Lucknow

- 24, Aug 2021

Why in News:

The Finance ministry has recently said that the Green field assets will be monetized .

About :

Greenfield and brownfield investments are two types of foreign direct investment.

- With greenfield investing, a company will build its own, brand new facilities from the ground up.

- Brownfield investment happens when a company purchases or leases an existing facility.

- In a greenfield investment, parent companyopens a subsidiary in another country. Instead of buying an existing facility in that country, the company begins a new venture by constructing new facilities in that country.

- Brownfield investments, an entity purchases or leases an existing facility to begin new production.

- Companies may consider this approach a great time and money saver since there is no need to go through the motions of building a brand new building.

India Investment Grid:

- India Investment Grid (IIG) is an initiative of Department for Promotion of Industry & Internal Trade (DPIIT) Ministry of Commerce, Government of India and Invest India, the National Investment Promotion and Facilitation Agency.

- The India Investment Grid (IIG) is a home for investment opportunities across India which works on a single interactive platform.

- This was formed as an initiative to enhance the business platform in India.

Invest India:

- Invest India is the National Investment Promotion and Facilitation Agency of Indiaand acts as the first point of reference for investors in India.

- It is set up as a nonprofit venture under the Department for Promotion of Industry & Internal Trade (DPIIT), Ministry of Commerce and Industries, Government of India.

- Operationalized in early 2010, Invest India is set up as a joint venture company between the Department for Promotion of Industry & Internal Trade (DPIIT) (35% equity), Federation of Indian Chambers of Commerce and Industry (FICCI) (51% equity), and State Governments of India (5% each).

Facts for Prelims:

Reverse Greenshoe Option

The definition of a reverse greenshoe option, also known as an overallotment option, is a provision used by underwriters in the initial public offering (IPO) process.

It is intended to provide increased price stability for the newly-listed security.