CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

Special status for Bihar

- IAS NEXT, Lucknow

- 17, Dec 2021

Reference News:

Nitish Kumar has again raised his nearly 15-year-old demand for the status of special category state (SCS) for Bihar. Nitish has been seeking SCS for Bihar since at least 2007.

Bihar’s development vis-a-vis other states:

- The latest report of the NITI Aayog puts Bihar among the bottom states in terms of growth rate and human development indices.

- Bihar’s annual per capita income of Rs 50,735 lags the national figure of Rs 1,34,432 by a significant distance.

- According to the report, 51.91 per cent of the state’s population — the highest in the country — lives below the poverty line.

- Bihar is also doing badly in terms of school dropouts, child malnourishment, maternal health, and infant mortality.

What is Special Category Status?

- There is no provision of SCS in the Constitution; the Central government extends financial assistance to states that are at a comparative disadvantage against others.

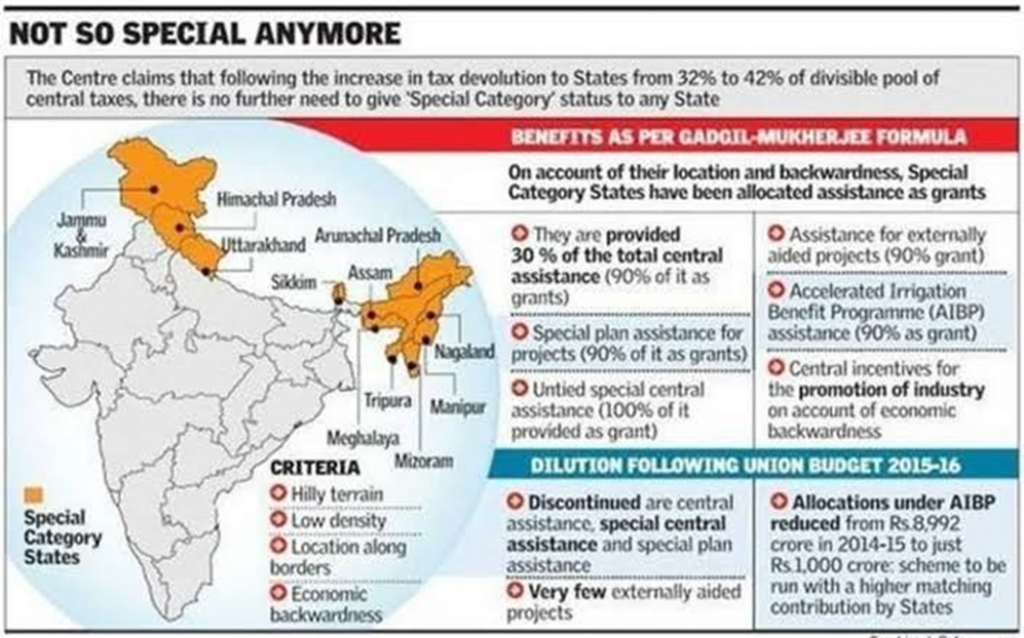

- This classification was done on the recommendations of the Fifth Finance Commission in 1969.

It was based on the Gadgil formula. The parameters for SCS were:

- Hilly Terrain;

- Low Population Density And/Or Sizeable Share of Tribal Population;

- Strategic Location along Borders With Neighbouring Countries;

- Economic and Infrastructure Backwardness; and

- Nonviable Nature of State finances.

Some prominent guidelines for getting SCS status:

- Must be economically backward with poor infrastructure.

- The states must be located in hilly and challenging terrain.

- They should have low population density and significant tribal population.

- Should be strategically situated along the borders of neighboring countries.

Who grants SCS status?

Special Category Status for plan assistance was granted in the past by the National Development Council to the States that are characterized by a number of features necessitating special consideration.

- Now, it is done by the central government.

Benefits:

Besides tax breaks and other benefits, the State with SCS will get 90% of all the expenditure on Centrally sponsored schemes as Central grant. The rest of the 10% will also be given as a loan at zero percent interest.

Concerns associated:

Considering special status to any new State will result in demands from other States and dilute the benefits further. It is also not economically beneficial for States to seek special status as the benefits under the current dispensation are minimal. Therefore, States facing special problems will be better off seeking a special package.

Present scenario:

The 14th Finance Commission has done away with the ‘special category status’ for states, except for the Northeastern and three hill states.

- Instead, it suggested that the resource gap of each state be filled through ‘tax devolution’, urging the Centre to increase the states’ share of tax revenues from 32% to 42%, which has been implemented since 2015.