CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

What is Adjusted gross revenue (AGR)?

- IAS NEXT, Lucknow

- 27, Oct 2021

Bharti Airtel has decided to opt for the four-year moratorium on Adjusted Gross Revenue (AGR) and spectrum payments, making it the second telco after Vodafone Idea to accept the offer, which was part of the recently announced telecom relief package.

Background:

The Union Cabinet had in September approved several measures to extend lifeline to the cash-strapped telecom sector, including a four-year moratorium on payment of dues to the government arising out of the AGR judgment as well as payments of spectrum purchased in past auctions.

- The government had asked the telecom companies to convey their decision on opting for the four-year dues moratorium by October 29, while also giving 90 days’ time to indicate if they wanted to opt for converting the interest amount pertaining to the moratorium period into equity.

What is AGR?

Adjusted Gross Revenue (AGR) is the usage and licensing fee that telecom operators are charged by the Department of Telecommunications (DoT). It is divided into spectrum usage charges and licensing fees, pegged between 3-5 percent and 8 percent respectively.

- As per DoT, the charges are calculated based on all revenues earned by a telco – including non-telecom related sources such as deposit interests and asset sales.

What was the relief package ?

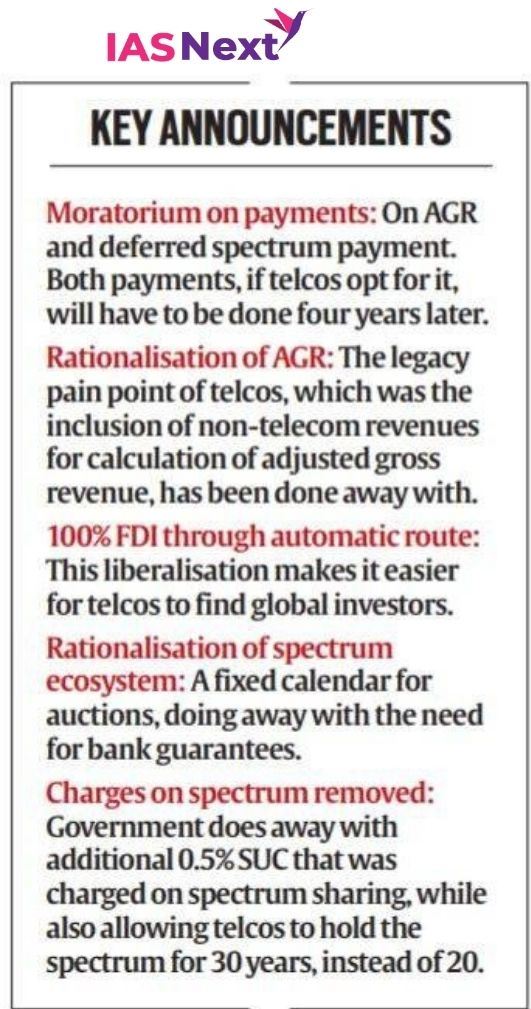

- Package includes a four-year moratorium on payment of statutory dues by telecom companies as well as allowing 100% FDI through the automatic route.

- The wide set of measures proposed entail reforms for the ailing sector by way of granting moratorium on unpaid dues, redefining djusted Gross Revenue (AGR) prospectively and cutting in Spectrum Usage Charges.

How does the package help?

- It provided much needed relaxation to telecom companies Vodafone Idea, Reliance Jio and Bharti Airtel.

- These are expected to protect and generate employment opportunities, promote healthy competition, protect interests of consumers, infuse liquidity, encourage investment and reduce regulatory burden on Telecom Service Providers (TSPs).

- A moratorium on AGR-related dues will offer space to the cash-strapped firm to improve its business and clear dues over a longer period.

- The definition of AGR has been changed to exclude non-telecom revenue. All non-telecom revenue will be removed from AGR.

But how did the financial condition of the telcos deteriorate?

Let’s understand this in three simple steps:

- It started by and large with the differing legal interpretation of AGR. To understand this, one must go back to 1999, when the government decided to shift from a fixed to a revenue-sharing model for the telecom sector. Telecom players would pay a certain percentage of their AGR, earned from telecom and non-telecom revenues, as licence and spectrum fee.

- In 2003, the Department of Telecom (DoT) raised the demand for AGR payments. It said all revenue earned by telcos as dividend from subsidiaries, interest on short-term investments, money deducted as trader discounts, discount for calls and others, which was over and above the revenue from telecom services, would be included for calculation of AGR.

- The telcos approached the Telecom Disputes Settlement Appellate Tribunal (TDSAT), which in July 2006 ruled the matter must be sent back to the regulator TRAI for fresh consultation. TDSAT rejected the government’s contention, and the Centre moved the Supreme Court. While the case was still ongoing, in 2012, the Supreme Court cancelled 122 telecom licences in the 2G scam case. This prompted a revamp, with spectrum now allocated through auctions.

What was the Supreme Court verdict?

In 2019, the Supreme Court gave the first verdict in the case, holding that DoT’s definition of AGR was the correct one, and that the telcos must pay the AGR, interest and penalty on non-payment.