CURRENT AFFAIRS

Get the most updated and recent current affair content on Padhaikaro.com

What is Input Tax Credit (ITC)?

- IAS NEXT, Lucknow

- 14, Oct 2021

GST Network has said it has blocked Rs 14,000 crore worth of input tax credit (ITC) of 66,000 businesses registered under the Goods and Service Tax.

Background:

The government had introduced Rule 86A in GST rules in December 2019 giving powers to taxmen to block the ITC available in the electronic credit ledger of a taxpayer if the officer has “reasons to believe” that the ITC was availed fraudulently.

What is Input Tax Credit (ITC)?

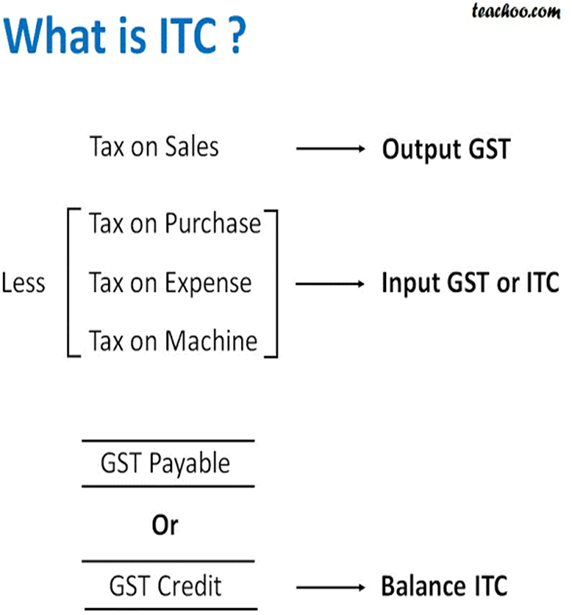

- It is the tax that a business pays on a purchase and that it can use to reduce its tax liability when it makes a sale.

- In simple terms, input credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs and pay the balance amount.

Exceptions: A business under composition scheme cannot avail of input tax credit. ITC cannot be claimed for personal use or for goods that are exempt.

Concerns over its misuse:

- There could be possibility of misuse of the provision by unscrupulous businesses by generating fake invoices just to claim tax credit.

- As much as 80% of the total GST liability is being settled by ITC and only 20% is deposited as cash.

- Under the present dispensation, there is no provision for real time matching of ITC claims with the taxes already paid by suppliers of inputs.

- Currently there is a time gap between ITC claim and matching them with the taxes paid by suppliers. Hence there is a possibility of ITC being claimed on the basis of fake invoices.